F2F #32: Business BLANDgels

Your cap table is not a trophy shelf. It’s your toolkit.

A couple of issues ago, I was tinkering with ChatGPT's Advanced Voice mode and I found something interesting. Read F2F #30: From blank canvas to product in 22 minutes for the full context.

After having talked to the AI for half an hour, it dawned on me that most startups don't know their angel investors very well. In fact, first-time entrepreneurs know their cap table even less well because of two reasons: first, they tend to get more generalist investors that don't have the network to invest in better deals, so they invest in what they can; and second, because beggars can't be choosers, so if someone brings in "a few friends syndicated", why not, let 'em all in even if you don't know them because the end of closing the round justifies the means.

Serial entrepreneurs, on the other hand, get to cherry-pick their investors more often, so they can filter out people they don't know or with an unclear value proposition and, on top of that, they can hand out individual invites to certain investors to join in for very specific reasons (field knowledge, certain connections in the industry, technical expertise, etc.).

I have talked to most of my portfolio companies, and most of them agreed on saying that they have a close relationship with only 2-3 angel investors (talk every week, if not every day) and a looser and even non-existent relationship with the rest of them.

How it plays out as a founder

You raised a round. The angels rolled in. Some you knew. Some just showed up through syndicates or cold outreach on LinkedIn or even pitching at beauty contests pitching events.

Fast forward a few months… and you don’t even remember what half of them promised (or if they even promised anything). You've got too much in your head, on your plate. They have other businesses and investments to attend to.

Welcome to the world of Business BLANDgels - the angels that take your call only when there’s a liquidity event in sight… or when you tag them in a LinkedIn post.

It’s time to flip the script. Let me introduce you to a little framework I call: KYA (Know Your Angels).

What’s KYA?

KYA is an internal audit system for your investor list. Not for fundraising, not for bragging rights, but for operating. You treat your investors not as status symbols but as tools. Some are hammers. Some are duct tape. Some… are just decorations.

It’s a living document, not a Notion graveyard. Something you actively revisit, update, and use.

Categorising your Cap Table

Break them down based on actual contribution — not potential, not vibes, not I think he said he’d intro me to someone at Sequoia.

Here’s a basic grid you can use (fill it in like a CRM):

|

Name |

Value |

Score (1–5) |

Last interaction |

Notes |

|---|---|---|---|---|

|

Jessica Fernster |

CTO-on-demand, advice |

5 |

Last week |

Helped source lead investor + hires + tech brainstorming |

|

Javier Lee |

Brand |

3 |

2 months ago |

Great for deck, not hands-on, brags a lot on social media to his 100k followers |

|

John Almendro |

Zero |

1 |

Never |

Syndicate filler. No clue what he does. |

Notice a few things:

- When I come up with fake names, almost always I end up choosing names starting with J. Does that happen to you too?

- Treat it like a CRM: low maintenance, high density of value per word.

- Focus on growing your relationship with those rated 4 or 5. Maintain strategic communications with 2s and 3s. Don't spend time with 0s or 1s (the downside of doing so is bigger than the upside).

So, how do you rate your investors?

• 🧠 Expertise (product, ops, hiring, technology etc.) - Example: you might want a few CTOs as investors if you don't plan to have one in-house because tech isn't core to your business but still need someone to take a look at what you're doing from the technical standpoint.

• 💰 Fundraising (warm intros, co-investing, strategy) - Example: some investors are also LPs in funds that can invest in the next round. Others, like me, don't write big checks but they always convince other people to co-invest with them, and they're good to help close rounds. Bit of a humblebrag here 🤘

• 🎯 Brand/Signaling (name in deck moves the needle) - Example: A few people are super well known. Not only celebrities, but certain business angels draw more investors only because they're in your deck. That is also of value.

• 📞 Availability (quick calls, hands-on help) - Example: Someone that always answers on whatsapp or is available to meet for brainstorming, advice or just lend a hand putting out fires. That has also a lot of value in the day to day of startups.

• 🛜 Network: usually people from the specific sector you operate in. If you're building a fintech, having the VP of a big banking institution or something like that can help you open doors in the industry.

Just a last consideration for the ratings: give only a five to people you will want to sit on your board as an independent board member or advisor. Remember that most typically there is only one board seat allocated for this, so choose wisely that one person and give 4s to the rest.

How to keep it alive?

Make KYA part of your monthly or quarterly reporting ritual. Not to report to them, but to remind yourself who’s bringing value and who’s just extra rows in the cap table.

When I read monthly/quarterly reports from my 30+ portfolio companies, I usually skim through the data and go straight to the "asks" section. Data is great, but at seed/pre-seed is mostly make-believe and volatile. Not to discount that whoever presents the data owns the narrative, and so I always read that frowning and with perhaps excessive skepticism.

I like answering the reports just to let them know that there's someone out there. I know how it feels to receive no answers to an important email.

But I am surprised that a lot of companies don't add the "asks" section to their report. It's then their fault if their cap table isn't helping them. If you don't ask for help, you can't complain later about your investors not adding value.

This will give you the temperature of each relationship. If someone falls off the radar, reach out on a separate email. Sometimes all they need is a nudge. Some investors auto-archive the reports or just postpone reading them indefinitely.

If they ghost you twice? Cool. Just adjust their value. Keep it professional, not personal. We all have got a lot going on with our own lives.

Also, you might think: "wait, but this doesn't scale. I've got 86 investors". Sure, but as I mentioned, you might be missing out on the 2-3 that really move the needle.

A few iterations of KYA and you will have found out the 5-10 individuals you can rely on. The interactions with these exceptional individuals have to be net positive for you, so it doesn't feel like you're wasting your time.

Examples

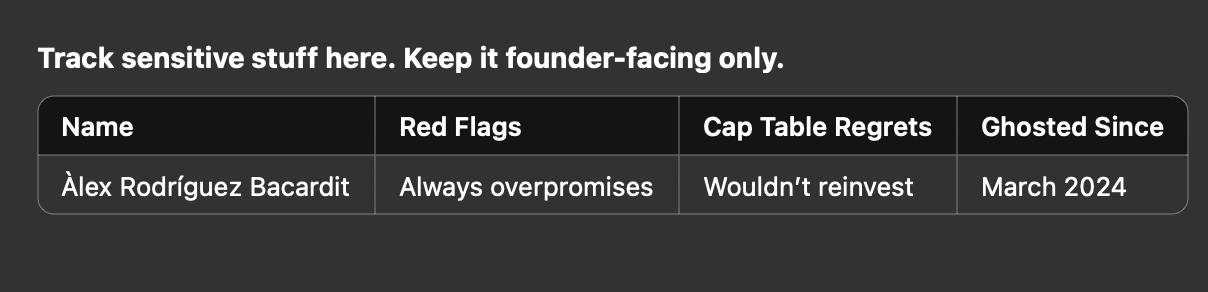

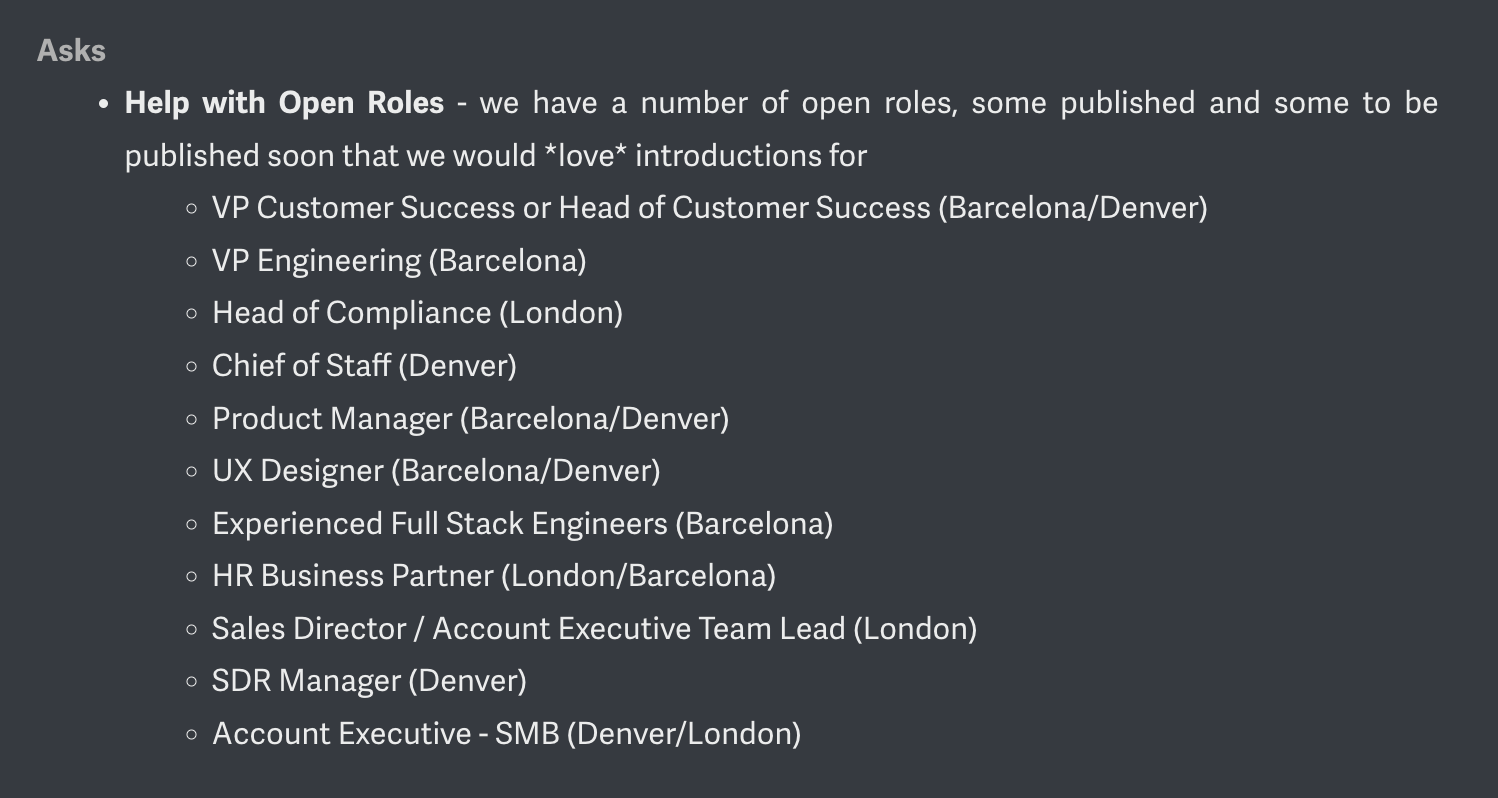

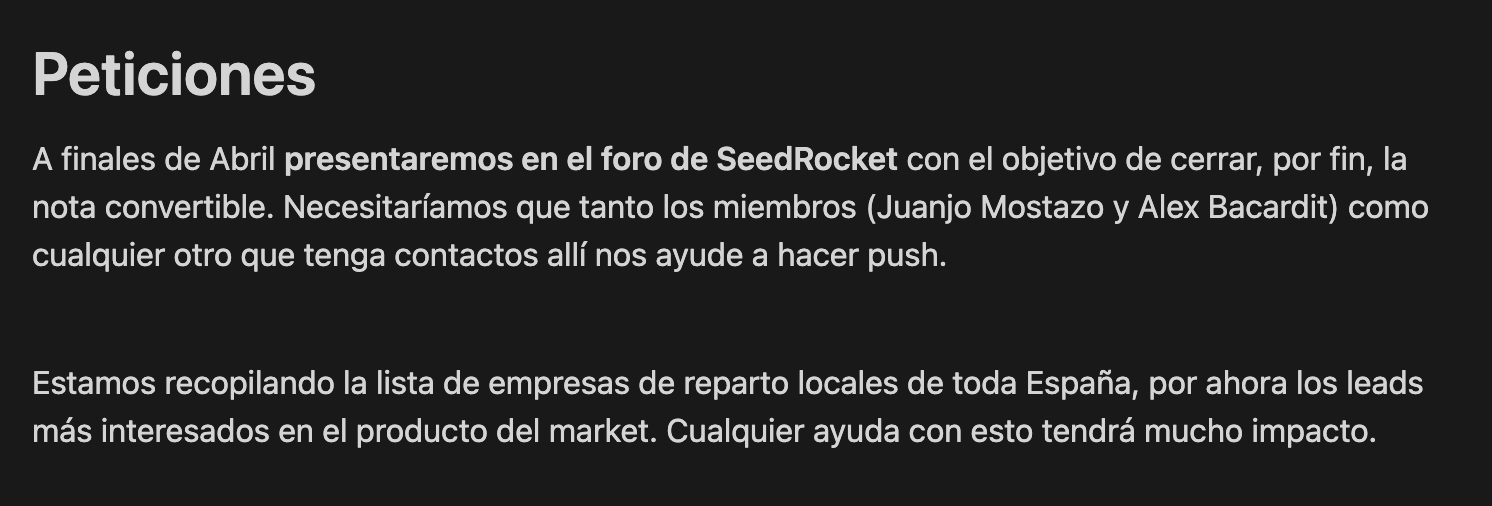

First, don't do it like this:

- Introduce us to amazing people! we're hiring a lot so just introduce us to everyone you think it's a good fit!

- Download our app and test it! we need more QA.

- We're live! spread the word on social media!

The above are too generic and signal that you're just getting started and have no strategy yet for these areas. It's a lazy approach to getting things done for free by someone who actually paid you to give them more work!

These are good examples:

These two, conversely, are straight to the point, write clear actions & targets and really succeed in rallying the troops.

Why bother?

Because in pre-seed, every minute matters. And because a bland angel today might be your sharpest ally tomorrow - if you learn how to use them. Or maybe they’re dead weight, and it’s time you stopped giving them mental bandwidth.

Either way, knowing is better than guessing.

Know Your Angels.

Bonus: want the template?

I'm still working on it, and I will send it first to my portfolio companies, but if you want it too, simply reply to this email and I will send it to you in exchange for feedback.